SOL Price Prediction: Key Levels and Catalysts to Watch in 2025-2040

#SOL

- Technical Outlook: SOL tests $165 support with mixed signals from MACD and Bollinger Bands.

- Market Sentiment: Divided views amid bullish catalysts (Seeker phone) and bearish pressures (whale movements).

- Long-Term Trajectory: Potential for multi-year growth if key adoption milestones are met.

SOL Price Prediction

SOL Technical Analysis: Key Levels to Watch

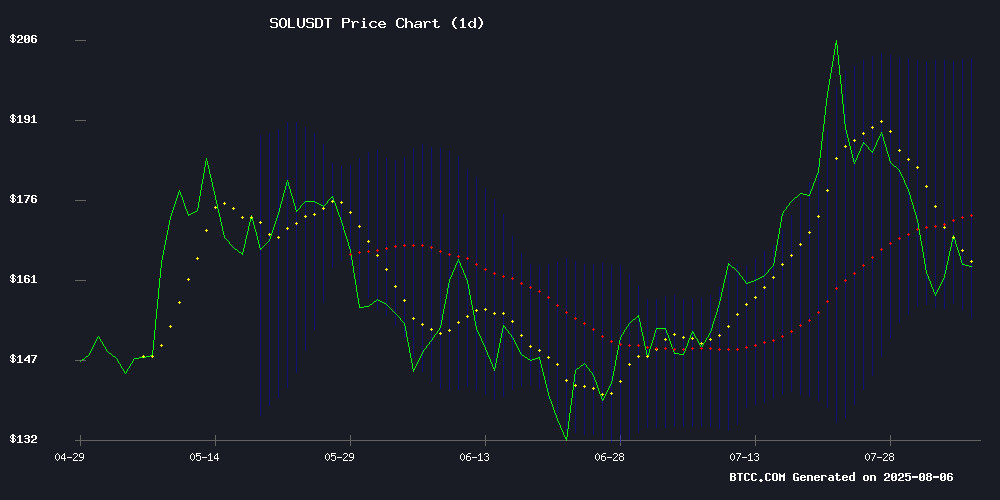

According to BTCC financial analyst Emma, SOL is currently trading at $165.61, below its 20-day moving average of $178.33, indicating potential short-term bearish pressure. The MACD shows a bullish crossover with the histogram at 11.2957, suggesting some upward momentum. However, the price is NEAR the lower Bollinger Band at $154.48, which could act as support. A break below this level might lead to further downside, while holding above it could signal a rebound towards the middle band at $178.33.

Market Sentiment Mixed as SOL Tests Critical Support

BTCC financial analyst Emma notes that Solana's market sentiment is divided. While the launch of Hyperliquid’s upgrade and the Seeker phone shipments are bullish catalysts, the struggle to break resistance and whale transfers to Binance raise concerns. The $165 support level is pivotal; holding it could pave the way for a Q3 rally, but failure may lead to deeper corrections. Regulatory clarity on staking tokens adds a neutral-to-positive backdrop.

Factors Influencing SOL’s Price

Hyperliquid’s Record July Hints at Bigger Ambitions as Key Upgrade Nears

Hyperliquid is emerging as a dominant force in decentralized finance, capturing 35% of all blockchain revenue in July. The platform's success is tied to its ability to leverage Solana's growth, offering a streamlined product that appeals to traders. With 63% of 24-hour trading volume and a 74% market share in perpetual contracts, Hyperliquid is rapidly becoming the go-to venue for decentralized derivatives.

Open interest surged to $15.3 billion, marking a 369% year-to-date increase. Over $5.1 billion in USDC has been bridged, signaling strong liquidity inflows ahead of upcoming integrations. The shift toward non-custodial DeFi solutions reflects growing distrust in centralized exchanges amid regulatory scrutiny.

The impending HIP-3 upgrade promises to transform Hyperliquid into a comprehensive Web3 infrastructure ecosystem. This milestone could solidify its position as a cornerstone of decentralized finance, attracting even broader institutional and retail interest.

Solana Faces Pivotal Moment at $165 Support Amid Divergent Market Views

Solana's price action hangs in the balance as it tests a crucial support level at $165, where 44.4 million tokens—7.42% of circulating supply—cluster. The cryptocurrency's 9.6% rally on Tuesday, fueled by solana Mobile's global Seeker smartphone shipments to 50+ countries, proved short-lived as prices retreated from a multi-day high of $171.

Market sentiment remains fractured. Bulls eye new all-time highs this quarter, while bears warn of a 10-15% correction to $140-$150. The altcoin has oscillated between $140-$180 since April, briefly breaking range highs in July to touch $206 before retracing. Technical analysts highlight $165 as a make-or-break level, with UTXO data suggesting concentrated liquidity at this threshold.

Solana Hits Record Activity Amid Whale Transfers to Binance

Solana's network activity surged to unprecedented levels in July, with non-voted transactions reaching an all-time high and true TPS averaging 1,318—the highest ever recorded. The blockchain's Total Value Locked (TVL) in native SOL terms also climbed to a three-year peak, signaling robust adoption among DeFi users and protocols.

Despite these bullish metrics, on-chain data reveals a contrasting trend: whales are quietly offloading SOL. Galaxy Digital unstaked 250,000 SOL ($40.7 million) and deposited it into Binance, followed by another whale moving $4.9 million worth of SOL after a two-month dormancy. The divergence between network growth and institutional sell pressure raises questions—whether this reflects healthy profit-taking or a strategic retreat.

Solana Eyes Q3 Rally Amid Key Support Test, Analysts Divided

Solana (SOL) surged 9.6% this week as Solana Mobile began global shipments of its Web3 smartphone, briefly pushing the asset to $171 before retracing to $160-$164. The altcoin has oscillated between $140-$180 since April, with a June dip to $120-$130 followed by a July rally to a five-month peak of $206.

Analyst Ali Martinez identifies $165 as critical support using UTXO data, suggesting this level could determine SOL's next major move. While some predict a retest of range lows, others anticipate a Q3 breakout. "The real MOVE comes after consolidation," notes a trader, referencing SOL's history of explosive rallies post-accumulation.

Market watchers are split on whether Solana's 25% correction from recent highs signals exhaustion or a healthy reset. The altcoin's correlation with Bitcoin ETF flows and institutional interest in Solana-based projects remain key variables.

Solana Struggles to Break Resistance as Momentum Wanes

Solana (SOL) faces renewed selling pressure after failing to sustain a breakout above key resistance at $171. The token retreated to $163.98, marking a 3.29% daily decline despite a 23% surge in trading volume. Technical indicators paint a bearish picture—the RSI languishes at 44.72 while a MACD crossover signals weakening momentum.

The asset remains trapped in a multi-year range between $130 support and $210-$220 resistance. A fleeting December 2024 rally past $300 proved ephemeral, with SOL quickly retreating to its established trading band. The current pullback tests interim support NEAR $160 as traders await the next catalyst.

ONyc Launches on Kamino, Bringing Real-World Yield to Solana DeFi

OnRe's yield-bearing asset, ONyc, is now live on Kamino, Solana's largest DeFi money market. This marks the first integration of reinsurance-backed yield as onchain collateral in Solana's ecosystem. The move unlocks real-world yield sources for DeFi applications, offering users a stable, liquid asset with a base yield of ~14%+ uncorrelated to crypto volatility.

Kamino, which secures over $700M in stablecoin TVL, now enables ONyc holders to deploy capital across market conditions. Users can leverage the asset for borrowing, lending, or looping strategies while maintaining 24/7 liquidity. Real-time NAV tracking through verifiable pricing data adds transparency to positions.

Incentive programs from USDG and Ethena aim to reduce borrowing costs and enhance yield opportunities. The integration represents a significant step toward bridging traditional finance yield sources with decentralized applications on Solana.

Solana Launches Second-Generation Crypto Smartphone, Seeker

Solana Mobile has commenced shipments of its Seeker smartphone, marking a significant push to integrate blockchain functionality into mainstream devices. The rollout, which began on August 4, 2025, spans over 50 countries, with preorders surpassing 150,000 units—far exceeding the first-generation Saga's production numbers.

In a recent interview on the When Shift Happens podcast, Solana co-founder Anatoly Yakovenko emphasized the device's security features, leveraging modern chipsets for cryptographic signatures akin to hardware wallets. "Mobile was my baby," Yakovenko noted, referencing his tenure at Qualcomm and the untapped potential of smartphone security stacks.

The Seeker aims to address both user experience and developer economics, offering a crypto-native app store that bypasses traditional 30% platform fees. Yakovenko likened the device to "the tricorder from Star Trek," underscoring its potential to redefine on-chain interactions.

Base Surpasses Solana in Daily Token Launches Amid Zora and Farcaster Integration

Coinbase-incubated LAYER 2 network Base has overtaken Solana in daily token launches, driven by integrations with Zora and Farcaster. Data from CryptoRank and Dune Analytics shows Base's daily token deployments more than doubled Solana's at its peak, with a record 54,341 tokens launched on July 27.

The surge follows Zora's ERC-20 tokenization of social posts and Farcaster's decentralized distribution tools, creating a feedback loop of speculative activity. Automated Uniswap liquidity pools further incentivized the trend, propelling Base's daily volumes from 6,600 to over 45,000 tokens by month-end.

Solana Price Prediction: Seeker Phone Launch Sparks Bullish Momentum

Solana's native token SOL gained 1.5% as the blockchain's flagship mobile device, the Seeker phone, began global shipments to 50+ countries. The Web3-integrated smartphone features hardware-level security for private keys and an alternative DApp store, positioning Solana as a developer-friendly platform free from traditional app store fees.

Market analysts suggest the device's rollout could accelerate mainstream adoption, with SOL potentially breaking out of a 4-month ascending channel pattern. The $1,000 price target—once considered ambitious—now appears within reach as infrastructure meets consumer demand.

Tens of thousands of units shipping worldwide mark a pivotal moment for Solana Mobile's vision. The project demonstrates how blockchain functionality can be seamlessly embedded in everyday technology, creating new utility for SOL tokens beyond speculative trading.

Solana Price Surges as Seeker Phones Begin Global Shipments

Solana Mobile has initiated worldwide deliveries of its second-generation Web3 smartphone, the Seeker, sparking a 6% price rally for SOL. Over 150,000 pre-orders and a robust DeFi ecosystem with $9.8 billion in total value locked underscore the device's potential as a catalyst for broader adoption.

The Seeker's integrated Solflare wallet, Seed Vault security, and access to 2,500+ dApps position it as a gateway to mobile-native decentralized finance. Technical indicators suggest SOL could test the $180-$185 resistance zone if it clears the current $171.12 Fibonacci barrier.

SEC Clarifies Stance on Liquid Staking Tokens, Exempts Certain Structures from Securities Rules

The U.S. Securities and Exchange Commission has issued new guidance suggesting that liquid staking protocols and their associated receipt tokens may not qualify as securities under specific conditions. The announcement, published by the SEC's Division of Corporation Finance, provides much-needed regulatory clarity for the rapidly growing staking sector.

Liquid staking allows cryptocurrency holders to deposit assets with third-party providers while maintaining liquidity through tradable receipt tokens. These tokens represent both the staked assets and any rewards earned, functioning as proof of ownership without requiring lock-up periods typical in traditional staking arrangements.

The regulatory clarity comes as major protocols like Solana have begun implementing liquid staking solutions. Market participants view the SEC's position as a potential catalyst for further institutional adoption of staking mechanisms across blockchain networks.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Here’s a long-term outlook for SOL based on current technicals and market dynamics:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $150-$250 | Adoption of Seeker phone, DeFi growth, macro trends |

| 2030 | $500-$1,000 | Institutional adoption, scalability solutions |

| 2035 | $1,500-$3,000 | Mainstream Web3 integration, regulatory clarity |

| 2040 | $5,000+ | Network maturity, global decentralized infrastructure |

Note: These projections are speculative and depend on ecosystem growth and macroeconomic conditions.